Security, Scalability or Decentralisation?

Blockchain and other Distributed Ledger Technologies (DLT) have had tradeoffs between security, scalability, and decentralisation since the early days of Bitcoin. This trade-off is known as the blockchain trilemma, and given the recent increase in blockchain use cases (from DeFi to bridges), it has become a major source of concern. Ethereum has been plagued by this trilemma, evident in its low transaction speed and throughput. In the past five years, Ethereum has made efforts to increase its transaction speed resulting in its September 15, 2022 transition from PoW to the Proof–of–Stake consensus algorithm. The PoS switch is arguably a tradeoff prioritizing scalability and security over decentralisation.

The ultimate question post-merge is, what is the implication of putting scalability and security ahead of decentralisation? In this blog post, we will compare how things were before and after the merge with respect to the Ethereum Blockchain trilemma.

What is the Blockchain Trilemma?

The blockchain trilemma term was first used by Ethereum’s co-founder Vitalik Buterin and highlights the three main issues – decentralization, security, and scalability – developers experience when building blockchains. Unfortunately, these issues force developers to “sacrifice” one feature as a tradeoff to ensure the other two features work perfectly. As a result, the blockchain trilemma concept has been widely accepted, resulting in the belief that decentralized networks can only provide two of the above features at any given time.

Many believe achieving all three aspects is impossible, at least not in the short term. However, ambitious projects are still working and touting that decentralized networks can have all three. An example of such a project is Algorand, whose algorithm randomly picks the network validator nodes to keep it secure. As a result, the blockchain is already secure against malicious attacks, with a reported 1,200 to 6,000 transactions per second.

Ethereum, on the other hand, aims to achieve 100,000 transactions per second – a gigantic leap from its current transaction processing speed – through:

- Proof of stake migration

- Sharding and Rollups

The idea behind these upgrades is to make the blockchain support more transactions securely while maintaining decentralization. The first phase kicked off in December 2020 with the creation of the Beacon Chain and concluded with the recently concluded merge with the mainnet. Sharding is another crucial part of Ethereum’s journey to solving its scalability headache. The idea is to store data and process transactions in partitioned nodes and chains called shards which are set to be released in 2023. The merge and PoS transition opened Ethereum to introducing sharding, which could be the main driver of low fees.

Which Blockchain Trillema Feature was lacking when ETH was PoW and what were the implications?

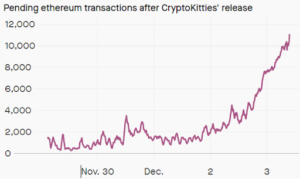

When Ethereum was still running the PoW consensus mechanism, there was a massive compromise on scalability, leading to high gas fees, low throughput, and network congestion. This compromise was created by Ethereum’s then proof-of-work consensus mechanism, which required network nodes to keep an accurate network state at all times. As a result, Ethereum’s transaction processing speed was limited to about 12-15 transactions per second. Additionally, the network suffered from congestion from time to time, with its biggest network congestion happening in the first week of December 2017. Then, CryptoKitties, a collection of cartoon kitten NFTs on the Ethereum blockchain had just turned into a viral sensation, sending the prices of some kittens to six figures and causing a network shutdown and pending transactions.

A major concern at the time was how these issues impacted mainstream viability. For example, the high gas fees priced out many smaller investors and dApp users from the network. Additionally, many crypto critics proclaimed that the congestion would majorly affect Ethereum’s market share as crypto was regarded as the replacement for traditional money-transfer channels like Western Union, SWIFT, and Paypal. Fortunately, many users discovered that Ethereum and its smart contracts are technological pillars with use cases beyond money transfers and payments.

Which Blockchain Trillema Feature was lacking now that ETH is PoS, and what implications (good & bad) should we expect going forward?

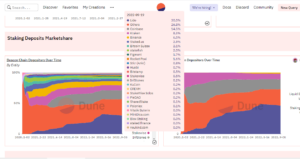

Ethereum’s transition to PoS unarguably comes with benefits like speed and eventually scalability. However, there’s still a tradeoff – security and centralization. Ethereum is now (objectively) more centralized than it was when using PoW. The centralization tradeoff was massive, as can be seen in the Dune Analytics dashboard and table below:

The table above shows that Lido constitutes 30%, Coinbase has 14.54%, and Kraken has 8.32%. Essentially, over 52% of the total stake of these three entities controls Ethereum. This staking market share centralization can be interpreted as negative as these entities now have majority control over the network.

Additionally, most of the 4,653 active Ethereum nodes are hosted by centralized web providers like Amazon Web Services, which could “expose Ethereum to central points of failure,” according to crypto analytics platform Messari. Furthermore, Ethernode data reveals that nodes are geographically concentrated in the United States (44.56%) and Germany (12.24%), accounting for about 56% of all Ethereum nodes worldwide. As a result, government interference from the two nations could significantly influence Ethereum’s node decentralization.

Now, what do all these mean for the future of Ethereum? By switching from PoW to PoS, there was a clear tradeoff between decentralization and security to increase Ethereum’s speed and scalability.

That said, decentralization is a spectrum largely misunderstood because, despite our rocket-speed advancements, cryptocurrency is still nascent. Crypto is at a stage where centralization is needed to foster growth; therefore, projects need centralized elements before eventually achieving true decentralization. Whether Ethereum gets there purely depends on the core team and their vision for the blockchain.

About THRESH0LD

THRESH0LD offers a single, simple to integrate API that helps digital asset businesses such as crypto exchanges, payment processors and OTC solutions cut fees, save time and enhance security.

With THRESH0LD, you can:

- cut fees by over 85% for BTC, ETH and thousands of assets

- remove mass transaction challenges

- enjoy peace of mind with bank-grade wallet policies

- offer your customers new features (e.g. staking, lending & swapping)

- grow your user base, and

- maximise revenue…all with a 1-week integration

THRESH0LD currently supports 43 blockchain protocols and with our DeFiBridge, you get instant access to many thousands of assets.

Want to see how it works?