– Part of the Fee Intelligence Toolkit by THRESH0LD –

Not long ago, we published the second tool from our Fee Intelligence Toolkit: ETH Network Fees Savings Guide. The first tool being a savings guide for TRON network fees. We hope you find both helpful.

Here, we bring you another tool from our Fee Intelligence Toolkit: a guide on how exchanges can save on BTC network fees.

This guide covers;

- Background

- How It Works

- Network Fees

- Fee-Saving Strategies

- How THRESH0LD Helps

- Blockchain Characteristics

Background

Bitcoin was born in 2008, during the Great Financial Crisis, of a desire to build a purely peer-to-peer open source payment system capable of providing robust, secure and permissionless access to anyone wishing to send/receive funds over the Internet.

To date, the identity and whereabouts of Satoshi Nakamoto, the brain(s) behind Bitcoin, remain unclear but their invention has captivated the attention of millions and has grown to a level of adoption where bitcoins are now:

- being mined by energy companies in several countries

- accepted for the settlement of international oil purchases

- a legal tender in more than one country on two continents

- being traded by publicly listed companies and financial institutions

From less than a dollar in 2009 to close to $69,000 at the start of November 2021, the price of BTC is testimony for its ability to deliver an anti-fragile and highly secure payment system. And whilst some individuals and businesses have had funds stolen from their wallets by hackers, the Bitcoin blockchain remains uncompromised and has been online and available 24/7/365 for over a decade.

How It Works

The blockchain is in essence a ledger distributed amongst all network participants. This ledger contains the history of all confirmed transactions since its launch in 2009.

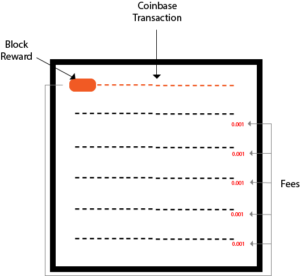

Transaction data is organised within blocks which may contain 2 types of transactions:

- regular transfers of existing bitcoins between wallet addresses

- creation of new bitcoins to reward those securing the network (known as coinbase transactions).

Importantly all blocks point to a preceding block and all confirmed transactions can be traced back to coinbase transactions by following how unspent transaction outputs (UTXOs) from newly mined bitcoins are progressively sent and combined as users transfer funds to others.

Network Fees

One of the reasons for the initial success of Bitcoin lies in the economic incentives offered to those willing to help secure the network: these actors, known as miners, earn network fees as well as newly mined coins for the block(s) they secure.

Bear in mind, at the time of writing, the amount of coins already mined is around 91% of the total supply (21 million BTC). Once all bitcoins have come into circulation, miners will only earn network fees.

Network fees are driven by the law of supply and demand:

- Miners compete to add incoming transactions to blocks every 10 minutes.

- Users compete to have their transactions added to the blockchain promptly.

Due to limitations imposed on the size of a block, network fees depend on the size of transactions (in bytes).

To understand how to save on fees, one must examine the anatomy of transactions: they consists of a vector of UTXO inputs, a vector of UTXO outputs and a header including a signature where:

- The inputs describe the source of funds being aggregated to amount to the total being sent out.

- The outputs describe the recipient(s) (one address or more) for the funds being sent.

- The signature provides the authorisation to transfer funds from input UTXOs.

Calculating network fees for a single signature segwit transaction can be done using the formula:

network fees = (transaction size in byte) * (fee in satoshi per byte)

where;

transaction size in byte = VIN_size * 148 + VOUT_size * 34 +10 where:

- VIN_size is the size of the input vector i.e. the number of UTXOs needed to fund the transaction.

- VOUT_size is the size of the output vector i.e. the number of addresses receiving funds (including the address receiving the transaction change, if any)

Importantly transactions where multiple signatures are needed to authorise the transfer of funds, are larger in size. The more signatures, the more space, and the greater the fees.

Users wishing to transfer funds on the Bitcoin network must specify the price they are willing to pay miners to process their transactions (this is usually done automatically by their wallet). To maximise their revenues, miners are incentivised to prioritise transactions with the smallest size and the highest offered fees. Users wishing to see their transactions processed and confirmed promptly will offer a higher fee to maximise the chance of this outcome. Offering a low fee may result in transactions held in the mempool (where miners pick unconfirmed transactions from) for an extended time.

To pay the minimum in-network fees, exchanges should consider the following fee-saving strategies:

Fee-Saving Strategies

1. Avoid Multisig Transactions

Where possible, avoid using multisig and use single-signature transactions instead. Multisig transactions can take between 20% and 60% more space in a block when compared to a single signature transaction. Consequently, multisig fees are also up to 60% more expensive.

For example, to benefit from multiple approvals, multi-signature wallets are not advised. Instead, it is more efficient to decouple the approval process from the transaction signing. This can enable multiple approvers, with transactions requiring only a single signature and enabling low costs.

2. Schedule Wisely

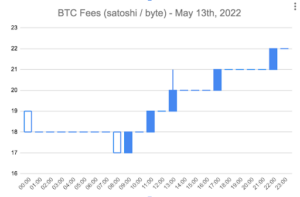

The Bitcoin network may experience congestion during different times of the day. During congested periods, it can be wise to avoid sending low denomination transactions and instead wait for more opportune times.

For example, on May 13th 2022, as can be seen on the chart below, BTC fees were as high as 22 satoshi/byte (between 10:00 PM and 12:00 PM UTC) and as low as 17 satoshi/byte (between 08:00 AM and 10:00 AM UTC).

Source: THRESH0LD

For a crypto exchange, choosing the right time to collect thousands of small deposits can have a significantly positive impact on cost management.

For a crypto exchange, choosing the right time to collect thousands of small deposits can have a significantly positive impact on cost management.

3. Group UTXOs

As alluded above, the bitcoin protocol allows for multiple UTXOs to be grouped into a single transaction. Doing so is more economical than sending multiple smaller individual transactions as these take more space in a block as they all bear their own header and signature.

Taking advantage of this grouping feature can help reduce the overall fee spending especially when collecting or sending small denomination payments.

4. Reduce Small On-Chain Transactions

Crypto exchanges often use multiple individual wallets to manage their customers’ funds: one to receive deposits, one to hold deposits, one to fund withdrawals. Before deposits are made available for withdrawals, funds may have been transferred on-chain once or twice with each transfer bearing a network fee.

Retail exchanges receiving and sending large numbers of small BTC denominations should consider reducing the number of on-chain transactions to further save on fees.

The best way to achieve this consists of making deposits immediately available for withdrawals and using a cost optimization strategy to pick the most appropriate UTXOs to fund payments.

How THRESH0LD Helps

At THRESH0LD, we pride ourselves on helping our customers appropriately secure their transactions and increase their bottom line.

Regarding Bitcoin network fees, our customers benefit from:

- the decoupling of approval from signature and the use of Multiparty Computation (MPC) to avoid costly multisig transactions

- the ability to schedule the collection of different denomination deposits at the most opportune times

- the ability to group up to 650 UXTOs per collection

- the ability to fund withdrawals from deposits and avoid on-chain transactions

- the automated selection of the most appropriate UTXOs to further reduce network fees on withdrawals

- and much more.

Interested in learning more about how THRESH0LD can help save on Bitcoin network fees?

Blockchain Characteristics

Consensus: Proof-of-Work

Block Frequency: ~ 10 minutes.

Smallest Denomination: 1 satoshi = 0.00000001 BTC

Network Fee Unit: satoshi per byte

Transaction Size: VIN_size * 148 + VOUT_size * 34 +10 (Segwit P2WPKH)

Transaction Fees = (network fee) * (transaction size)

BTC Supply Cap: 21 Million BTC

BTC Current Supply: ~ 91%