Ordinals, BRC-20 & High $Bitcoin Transaction Fees

By Ken Akure |12 May, 2023|

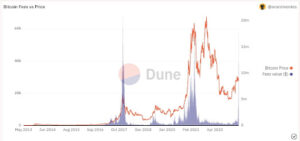

The implementation of the Bitcoin Ordinals protocol in January of 2023 enabled the creation of the BRC-20 token standard on Bitcoin. This improvement to Bitcoin triggered the 2023 meme coin mania causing a spike in Bitcoin mining fees to levels not seen since the bull run of 2017.

The Bitcoin Ordinals protocol allows users to create and trade unique NFTs. It utilizes the Bitcoin Taproot upgrade and on-chain content to facilitate the interaction and exchange of these tokens. The Bitcoin network comprises 100 million satoshis, each being a Bitcoin subunit and this Protocol enables users to inscribe permanent data on individual satoshi. The BRC-20 token standard has given rise to a novel type of non-fungible tokens (NFTs) or digital artifacts on the Bitcoin blockchain.

How have Ordinals affected the Bitcoin Network?

Ordinals NFTs aren’t user-friendly as yet as they can lead to the fragmentation of the Bitcoin network as different NFTs minters use different token numbering systems making it difficult for bitcoin nodes to validate these transactions. Here are some of the far-reaching implications of this:

- The Need for Storage Space

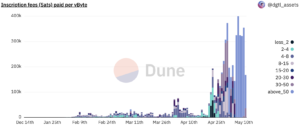

A total of 5,632,080 inscriptions have been made so far, with the total fees spent on Ordinals amounting to ₿1,163.7686 as seen on Dune analytics at the time of writing. Due to the economic incentive generated by BRC-20’s token minting, which is often performed on the smallest UTXO size possible, there has recently been a race for block space. Although the theoretical maximum size of a Bitcoin block is 4 MB, they usually cap out at around 1-2 MB. However, since ordinals were introduced, the average block size has increased from 1.5–2.0 MB to 3.0–3.5 MB.

- The Rising Cost of Transactions

Bitcoin transaction fees surpassed the block reward on May 7, 2023, at a block height of 788,695, for the first time since December 2017.

Previously sufficient for peer-to-peer transactions, the network’s capacity has become a concern as ordinals have generated more traffic, leading to network congestion and slower transactions. Because miners naturally prioritise Bitcoin transactions with greater fees to maximise their earnings, users have been forced to pay ever-increasing fees to guarantee the speed of their transactions.

According to Dune Analytics, the Bitcoin network witnessed a daily record of 682,281 transactions on May 8, with over 372,000 inscriptions created in a single day.

As of May 8th, there were over 440,000 pending Bitcoin transactions, with 193 blocks remaining to clear them all. Following that, fees spiked to over $25 per transaction, with an average fee of $19.20. Source: mempool

The obvious question then is, “What can be done to match the increasing cost of transaction fees? And in the long term, what can be done to increase the scalability of the Bitcoin network?”

Are Layer 2 Solutions the Answer?

Before now, Layer 2 solutions- like Lightning– have been considered as a possible solution to the problem of rising transaction fees on the Bitcoin network. These solutions involve off-chain transactions that occur outside of the main blockchain, thus reducing the strain on the network and lowering transaction fees. However, wide-scale adoption of this is yet to seeing partly due to the technical complexity bordering on its implementation.

How Thresh0ld Cuts High BTC Transaction Fees

Before now, we published the BTC Network Fee Savings Guide to help digital asset businesses such as crypto exchanges cut the cost incurred while processing mass bitcoin transactions. Here is a summary of the gas fee-saving tips we covered in the guide:

1. Avoid Multisig Transactions

They take up more space and can be up to 60% more expensive than single-signature transactions. Instead, consider separating the approval process from transaction signing to allow for multiple approvers while keeping costs low. Multiparty Computation (MPC) based enterprise wallet solutions like Thresh0ld enable this.

2. Schedule Wisely

The Bitcoin network can get congested at certain times, especially during the day- when markets and trading activities are highest. To save costs, avoid sending low denomination transactions during these times and wait for better opportunities. For crypto exchanges, timing the collection of small deposits can greatly cut costs.

3. Group UTXOs

The Bitcoin protocol lets you combine multiple UTXOs into one transaction. This is cheaper than sending individual smaller transactions, which take up more block space. Using this grouping feature can lower your fee costs, especially when dealing with small payments. Thresh0ld allows you to group up to 650 UTXOs.

4. Reduce Small On-Chain Transactions

Crypto exchanges use separate wallets for managing customer funds, such as receiving deposits, holding funds, and funding withdrawals. Funds may be transferred on-chain multiple times with fees before becoming available for withdrawals.

To save on fees, retail exchanges dealing with numerous small BTC denominations should reduce the number of on-chain transactions. They can do this by making deposits immediately available for withdrawals and using a cost optimization strategy to select the best UTXOs for funding payments. Thresh0ld Mass Dou Wallets handles this efficiently.

Thresh0ld Feature Update: Coming Soon!!!

The Ability to Set Custom Fees:

Currently, Thresh0ld has the ‘Auto Fee Feature’, which estimates the transaction fees over a period of specified blocks and picks an average. But with recent volatility in transaction fees, we are working on adding a custom fee feature to enable our clients to decide for themselves how much they would like to pay in BTC transaction fees enabling them to better manage wallet operations. So be on the lookout as we will notify you as soon as this goes live.

About THRESH0LD

THRESH0LD is a secure wallet infrastructure solution built to help blockchain companies such as crypto exchanges, payment processors, NFT Marketplaces, and OTC solutions cut transaction fees, efficiently manage millions of crypto transactions, save time with wallet automation, and enhance security.

We support 44 blockchain protocols and a DeFiBridge that enables swaps across thousands of assets. Thresh0ld is being deployed by over 80+ digital asset businesses across Africa, Australia, Europe, and Asia.

Found this piece interesting? Check out our other blog posts.