-A Mass Transaction Fee Saving Tool for Crypto Exchanges-

The Fee Intelligence Brief is an hourly, daily, weekly, monthly and quarterly report on the state of Ethereum and Bitcoin mining fees. Timely data on the state of mining fees enable crypto exchanges schedule mass collections and batch withdrawals at the time of the day when network fees are significantly low. Thereby, saving thousands of dollars on transaction fee costs.

FIB is a component of our fee savings toolkit for crypto exchanges. We have published other components of this toolkit consisting of fee-saving guides. Such as:

- ETH Network Fees Savings Guide

- Savings Guide for TRON network fees and

- How to save on BTC Mining Fees

We hope you find them helpful.

The Significance of Tracking Network Fees

Bitcoin mining fees are designated in Satoshi/byte whilst that of Ethereum is measured in gwei.

By tracking the fluctuations of mining fees throughout the day, we begin to see patterns emerge in both the short term (daily, weekly & monthly) and long term (Quarterly to yearly).

In the short term, it helps in transaction fee savings for crypto exchanges while in the long term, further correlations could be drawn against the broader crypto market dynamics such as, how high transaction fees on BTC and ETH might be directly related to market volatility or euphoria.

- Hourly Time Frame

For over a month, we have published data on Bitcoin and Ethereum mining fees daily on Twitter with estimates of how much crypto exchanges and other digital asset businesses could save for every 1000 transactions if they utilise transaction fee data and process mass transactions around a certain time period of the day. (See screenshots below)

We invite you to follow us on Twitter> @THRESH0LD_ for timely access to this data. The data published is gotten from the same data feed that populates these charts below.

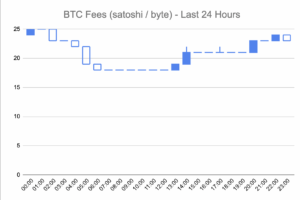

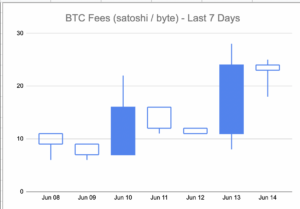

Chart 1 shows data for 14th June 2022. Here, we see that fluctuation in BTC network fee was minimal as it remained in a narrow range of 18 to 25 satoshi/byte. On other days, there could be a very wide gap between the lowest fee and the highest fee.

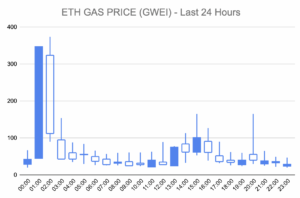

Chart 2- ETH Fees over 24hrs

Chart 2 captures ETH gas price for 14th June 2022. It shows gas price has a broader range, the minimum being 20gWei whilst the highest is 380 gwei.

By scheduling ETH mass collections and offering a gas price of 20 gwei, an exchange could have saved approximately $1066 on 1,000 transactions.

Hourly FIB

In Q3 2022, HOURLY Fee Intelligence Brief for clients only will be introduced. At the close of each hour, data on the state of Bitcoin & Ethereum transaction fees will be made available to clients. Correctly used, this will help with further cost savings.

Anticipate.

- Daily Time Frame

In chart 3 below, BTC Network fees had a wider range of between 9 to 29 satoshi/byte on 13th June 2022. Days like this signify the importance of picking average or lowest fees as it relates to minimizing transaction fees.

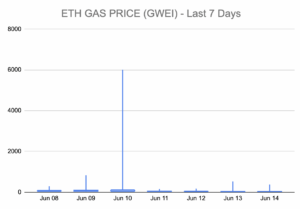

Chart 4 below shows ETH network fees over a 7-day period. On June 10, we saw a very unusual spike of up to 6005 gwei while the minimum transaction fee for the day was 24 gwei.

- Other Time Frames

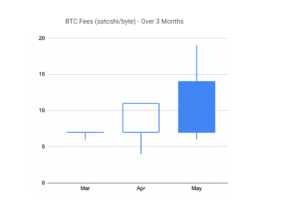

Chart 5 below shows that BTC network fees increased on average between March 2022 and May 2022.

In the next edition of our Fee Intelligence Brief newsletter, we will cover the state of mining fees over a few quarters. If you gained any insights from these charts, do give us a follow and a shout-out on Twitter> @THRESH0LD_