– Part of the Fee Intelligence Toolkit by THRESH0LD –

Recently, we introduced the first tool from our Fee Intelligence Toolkit: a savings guide for TRON network fees. We hope you found it helpful. Today, we’re bringing you another tool from our toolkit: a handbook on ETH gas fees savings.

This guide covers;

- Ethereum Background

- How do Network Fees work?

- Network Fees Saving Strategies

- How THRESH0LD Helps

- Blockchain Characteristics

Ethereum Background

Vitalik Buterin (Bitcoin Magazine) conceived Ethereum in 2013, with a group including Gavin Wood (DOT, KSM), Charles Hoskinson (ADA), Joseph Lubin (ConsenSys) and Anthony Di Iorio (Decentral). The blockchain went live on 30th July 2015. They were driven by the desire to improve on the programmability offered by Bitcoin and other existing blockchains.

As far as programmability is concerned, the Bitcoin blockchain offers simple operations such as timelock or multi-signature transactions. In contrast, the Ethereum Virtual Machine (EVM) provides a turing-complete set of instructions enabling complex smart contracts’ development, deployment, and execution.

Beyond programmability, the Ethereum blockchain also departs from the UTXO-based transaction protocol and instead offers an account-based protocol.

There are 2 types of accounts on Ethereum:

- User accounts that may create transactions and

- Contracts which are associated with code and storage.

Both account types have an ETH balance associated with a unique address and can send ETH to any account, call any public function of a contract or create a new contract.

How Do Network Fees work?

Similarly to Bitcoin, network fees are driven by the law of supply and demand:

- Miners compete to add incoming transactions to blocks every 12 seconds.

- Users compete with each other to have their transactions added by miners to the blockchain promptly.

However, Ethereum network fees do not depend on the transaction size in byte but rather on how resource-intensive transaction processing is for the EVM running on the miners’ nodes. This resource is commonly known as gas.

Different transaction types incur different gas fees:

– a single transaction (not using a smart contract) requires 21,000 units of gas

– a smart contract transaction requires larger amounts, increasing with the complexity of the smart contract.

Users wishing to transact on the Ethereum network must specify the price (in gwei) they are willing to pay miners for the gas required to process their transactions. Miners are incentivised to prioritise transactions with the highest offered gas price and the lowest complexity to maximise their revenues. Users wishing to see their transactions processed and confirmed promptly will offer a higher gas price to maximise the chances of this outcome. Offering a low gas price may result in transactions held in the mempool (where miners pick unconfirmed transactions from) for an extended time.

To pay the minimum in gas fees, you should consider the following fee-saving strategies:

Network Fees Saving Strategies

- Use Smart Contracts Sparingly

Where possible, avoid using smart contracts and use regular transactions.

For example, to have multiple approvals, multi-signature smart contracts are not advised. It is more efficient to decouple the approval process from the transaction signing. This enables multiple approvers, with the transaction requiring only 21,000 gas units and enabling low costs.

2. Schedule Wisely

The Ethereum network may experience congestion during different periods across the day. During congested periods, fees can escalate to levels where it becomes uneconomical to send small transactions.

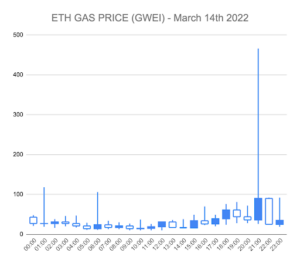

For example, on March 14th 2022, as can be seen on the chart below, ETH gas prices fluctuated between 466 gwei (between 09:00 PM and 10:00 PM UTC) and 10 gwei (between 09:00 AM and 12:00 PM UTC).

For a crypto exchange, choosing the right time to collect thousands of small deposits can have a significantly positive impact on cost management.

3. Bid Low & Accelerate If Need Be

The Ethereum network features the ability to replace a transaction with insufficient mining fees with one with higher fees. This process can be referred to as accelerating a transaction. Notably, a transaction can be accelerated as many times as needed.

Taking advantage of this feature can reduce the overall fee spending by following the strategy of bidding low and raising the price progressively if the transaction is taking more than the desired time to be processed by the network.

4. Monitor & Cap Your Spending

During days of intense network congestion, exchanges may choose to avoid collecting small deposits.

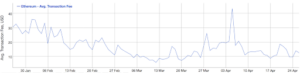

For example, on April 5th 2022, as illustrated in the chart below, the average USD transaction cost was above $40. During such days, placing a cap on how much fee should be offered to miners for small transactions can help avoid losses on deposit collections.

It can be beneficial for exchanges to monitor gas prices and wait for congestions to clear before attempting to collect small denomination deposits.

How THRESH0LD Helps

At THRESH0LD, we pride ourselves on helping our customers appropriately secure their transactions and increase their bottom line.

Regarding Ethereum network fees, our customers benefit from:

- the decoupling of approval from signature and the use of Multiparty Computation (MPC) to avoid costly multi-sig smart contracts

- the ability to schedule the collection of different denomination deposits at the most opportune times

- the ability to accelerate any transaction and benefit from a low bid strategy

- the ability to automate the acceleration of mass withdrawal transactions

- the ability to cap their collection spending and avoid losses on small deposits

- and much more.

Interested in learning more about how THRESH0LD can help save on Ethereum network fees?

Ethereum Characteristics

- Consensus: Proof-of-Work (soon to be replaced by Proof-of-Stake)

- Block Frequency: ~ 12 seconds.

- Smallest Denomination: 1 wei = 0.000000000000000001 ETH

- Network Fee Unit: gwei (1 gwei = 1,000,000,000 wei)

- Transaction Base Cost: 21,000 gas units