Central Bank Digital Currencies: Full Steam Ahead?

Green Light For Italy

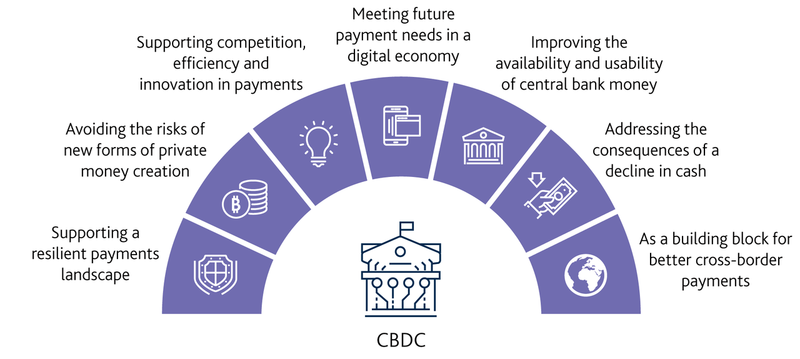

Over the last two years, many countries have been exploring the introduction of Central Bank Digital Currencies. In 2019, the Italian Banking Association (ABI), which has over 700 members, set up a working group focused on deepening their understanding of digital currencies. Last week, on June 18th the Executive Committee of the ABI announced that its members were ready to participate in pilot projects for a European-level CBDC.

“A programmable digital money represents an innovation able to profoundly modify the way we conceive currency and exchange,” announced the ABI. “This transformation can potentially deliver a great added value, in particular in terms of efficiency for both operational and support process. This is the reason why is so important to dedicate attention and energies to develop, quickly and in collaboration with the entire ecosystem, new instruments able to primarily support the development of the Euro area.”

The committee released last week a list of 10 essential criteria for a Central Bank Digital Currency. These essential criteria are meant to accelerate work which began a while ago in Italy. Did you know that 55 Italian banks are already operating on a blockchain infrastructure codenamed Spunta?

Concerns In The US

Meanwhile, the same week, on June 19th, the Federal Reserve of Philadelphia released a 32 page research paper entitled ““Central Bank Digital Currency: Central Banking for All?”.

The paper investigates the implications of “giving consumers the possibility of holding a bank account with the central bank directly”. The paper concludes with a series of stark warnings: To begin with, the availability of CBDC could hurt commercial banks as consumers would likely prefer holding their money in a central bank account than with commercial banks especially during times of crisis. With less deposits at hands, commercial banks would see their ability to lend suffer.

“During a panic, however, we show that the rigidity of the central bank’s contract with the investment banks has the capacity to deter runs. Thus, the central bank is more stable than the commercial banking sector,” the report states. “Depositors internalize this feature ex-ante, and the central bank arises as a deposit monopolist, attracting all deposits away from the commercial banking sector. This monopoly power eliminates the forces that induce the central bank from delivering the socially optimal amount of maturity transformation,” the report concludes.

Additionally the report warns if CBDC did disrupt the role of commercial banks and allowed the borrowing of more money than is lent out, the consequences could harm to the money markets.

“Our equivalence result has a sinister counterpart. If the competition from commercial banks is impaired (for example, through some fiscal subsidization of central bank deposits), the central bank has to be careful in its choices to avoid creating havoc with maturity transformation,” the paper reads.

What About Stable Coins?

As shown above, the jury is still out on the future of CBDC. Internal and external macro-economic forces may drive early adopters like Italy to go full steam ahead and launch a CBDC sooner rather than later. Other countries may choose to wait for the US Federal Reserve Bank to move first and/or learn important lessons from early experiments.

Meanwhile, as of last year, according to a report by BlockData, there were already 66 stable coins live with a further 134 under development. For over half of the active tokens, 36 of them, it took around one year from announcement to go live. Many of these coins are pegged to fiat currencies providing businesses with an option to hold and use digitised currencies such as USD, GBP, EUR, CHF, JPY, HKD, AUD, NGN to name a few. Since the launch of USDT on the Bitcoin Omni protocol in 2017, stable coins like GUSD, USDC, TUSD, PAX have been issued on a growing number of blockchains including Ethereum, Stellar, Binance and Tron.

Thresh0ld currently supports all stable coins issued as BTC Omni, ETH ERC20, XLM, BNB or TRC 10/20 tokens. As you know, we’re always working on adding support for more blockchains such as ADA which became available since last week.

Interested in securing your company’s stable coins with one of the most advanced and cost-effective solution to-date?