The rise of cryptocurrencies during the last decade has caused growing concerns among national and international regulators. The main risk that regulators often cite is that these instruments may constitute an innovative tool for money laundering.

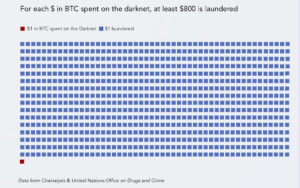

However, data from Chainalysis and the United Nations Office on Drugs and Crime revealed that traditional fiat money is used 800 times more than bitcoin (crypto) to launder money on the darknet.

From a criminological perspective, a Chainalysis report shows that transactions involving illicit addresses represented just 0.15% of cryptocurrency transaction volume in 2021, which pales in comparison to the total crypto transaction volume which grew by up to 567% from 2020’s totals. This growth shows the increasing demand for digital assets and, hence the need for regulation.

Regulations in the: EU, UK & US

On the global scene, the European Union (EU) is leading the charge in the regulation of digital assets. The Markets in Crypto-Assets Regulation (“MiCA”), due to be formally adopted in legislation in 2024, proposes to ensure that EU consumers gain safe exposure to innovative crypto-assets without creating challenges to market stability.

Following the EU closely in the regulatory race is the UK. The UK’s approach is a lot more focused. The regulatory moves hope to see stablecoins recognised as a valid form of payment as part of a more expansive plan to make Britain a global hub for digital asset technology and investment.

Over in the United States, the US President’s Working Group on Financial Markets released a report on stablecoins in November 2021. The report recommended the regulation of stablecoin issuers as banks and subjecting them to the exact requirements of traditional financial institutions. This includes holding appropriate reserves to avoid consumer runs and financial sector instability.

Building on that report, the US Senate has proposed the Stablecoin Transparency of Reserves and Uniform Safe Transactions (TRUST) Act of 2022. The Bill seeks to provide a regulatory framework and consumer protections for the issuance of stablecoins and other purposes.

The Act defines a payment stablecoin as a convertible virtual currency designed to maintain a stable value similar to a fiat currency. There is more than $178billion worth of stablecoins in circulation (as of the time of writing). The market leaders are USDT, USDC, BUSD, and DAI.

Some Important Questions

These are some questions that market players hope to find answers to:

- Why is the digital asset regulatory focus shifting towards stablecoins?

- Do we need regulations of the stablecoin market to address user protection and financial market stability, or is the market rather better off regulating itself?

- Can government regulation stop the rapid growth of the stablecoin market, or will it enhance it?

The regulatory focus on stablecoins stems from their similarities with fiat. There are suggestions that already existing currency and banking laws can and will be used in regulating them.

Stablecoin regulations are essential because these coins serve to grease the wheels of the crypto industry, enabling investors to quickly transfer value between different cryptocurrencies and crypto exchanges without swapping back and forth into dollars. Settlement is instant, thus avoiding delays of other means of payment. This function, coupled with their growing popularity, explains why stablecoins pose a systemic risk and hence the need for swift regulations.

Government regulations, if appropriately done might to some extent support the further integration of stablecoins into global payment systems as they can enhance financial inclusion by curing some of the existing payment system deficiencies such as:

- high transaction charges

- long settlement time and,

- barriers to entry

Stablecoins on THRESH0LD

THRESH0LD is growing the usage of stablecoins and cryptocurrencies in general by making it easy for digital asset businesses to process mass crypto transactions while saving as much as 80% in transaction costs.

We support USDT as TRC20, ERC20, MATIC-ERC20, BEP20, OMNI, SLP, and EOS tokens.

Other supported stablecoins are USDC, BUSD, DAI, TUSD, GUSD, and USDP (formerly Paxos Standard-PAX).

Want support for these stablecoins?

Get in touch! We are happy to help