In focus:

- Market: Bitcoin Mining Fees Spike by 499% in just a month!

- Regulation: US Banks can now provide Crypto Custody

- DeFi: $1B Milestone for MakerDAO

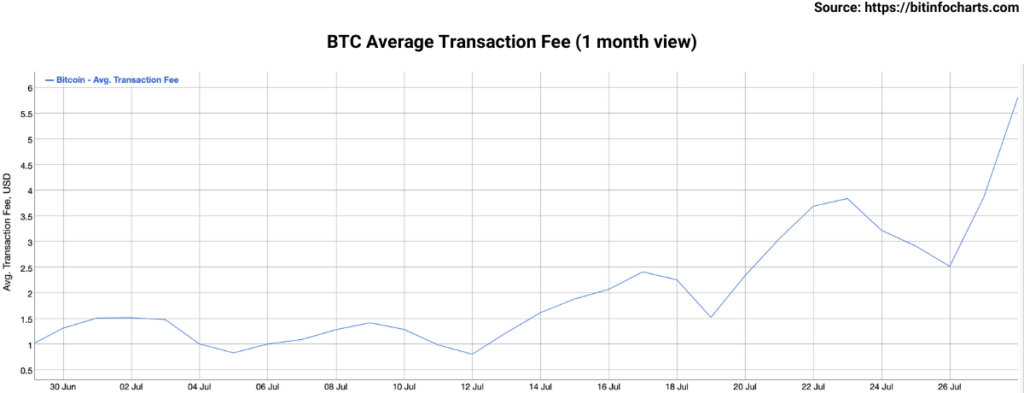

Bitcoin Mining Fees Spike by 499% in just a month!

Mining fees over the past month have increased to their highest levels this year since May. A month ago, on June 29th, the average BTC mining fees stood at $0.97. Today, they stand at $5.81 having increased by a whopping 499%! For companies relying on multi-sig that’s a potential cost of $9.47 per transaction!

Switch and save up to 63% on mining fees

Thresh0ld produces single signature transactions that are 23% to 63% leaner than multi-sig transactions. This means our customers enjoy lower operational costs, especially important during periods such as now where mining fees are bid up to avoid network congestion delays. And to deliver further savings on minings fees, Thresh0ld also enables the grouping of up to 2,000 payments in a single transaction on the BTC, LTC, BCH, BSV and DASH blockchains!

US Banks can now provide Crypto Custody

Last week, the Office of the Comptroller of the Currency (OCC) officially confirmed that United States national banks would be allowed to provide custody services with regards to cryptocurrencies. In practice, this means US nationally chartered banks are now allowed by the regulator to hold private keys on behalf of their customers. The quote below is from the OCC Interpretive Letter dated July 22nd, 2020:

“For the reasons discussed below, we conclude a national bank may provide these cryptocurrency custody services on behalf of customers, including by holding the unique cryptographic keys associated with cryptocurrency.”

Until now, the crypto industry had seen private companies such as Coinbase, BitGo and Gemini offer custodial services which required a state license. With this latest announcement, the industry will likely soon see regulated financial institutions, experienced at providing custodial services for assets such as stocks and bonds, enter the crypto custody market.

The Letter also explains that activities of a traditional bank, in safeguarding both physical and electronic assets on behalf of customers makes the provision of crypto custodianship services a “modern form” of permissible activity:

“The OCC concludes, that providing cryptocurrency custody services, including holding the unique cryptographic keys associated with cryptocurrency, is a modern form of these traditional bank activities.”

This letter also reaffirms the OCC’s position that national banks may provide permissible banking services to any lawful business they choose, including cryptocurrency businesses, so long as they effectively manage the risks and comply with applicable law.”

The US Acting Comptroller is Brian Brooks, the former Chief Legal Officer at Coinbase who took the AC position at the end of May 2020. Brooks is known for a pro-crypto stance which may well mean the dawn of a new era for this industry in the United States. With Brexit just around the corner, will the UK soon follow?

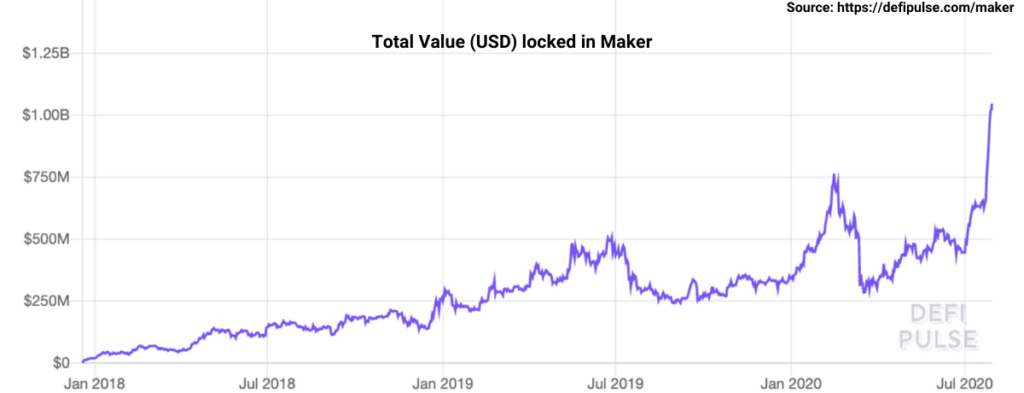

$1B Milestone for MakerDAO

The oldest project in the DeFi space, MakerDAO surpassed a huge milestone this week as it became the first DeFi protocol to have $1B in total locked value, meaning users have $1,000,000,000 in funds locked for lending activities. At the time of writing, DeFi Pulse places Maker dominance at 28.33% over other DeFi projects such as Compound and Synthentix.

In order to borrow DAI on Maker, users can collateralise tokens such as ETH, BAT, OMG, 0x, USDC and more, although the most locked asset is ETH. Currently ~2.4M ETH sit locked in the Maker protocol, valued around $770M at today’s prices. It should be noted that the recent 35% increase in ETH prices to $322 at the time of writing has been an important contributor to reaching this $1B milestone.

The DeFi market is growing rapidly, with the total value locked standing at $3.7B, having passed $1B back in February 2020. However, given the recent exploits witnessed in the space as hackers drained DeFi protocols such as bZx and dForce, it’s clear that the space still has a long way to go and security remains a central issue.