In focus:

- Mining Fees Up 751% in a month

- The Hidden Halving Message

- Paul Tudor Jones

On Monday 11th May 2020 at 19:23 UTC, the Bitcoin mining reward was halved down to 6.25 BTC at block 630,000 as expected. For the third time since 2009, the supply of newly minted BTC has been cut by 50%.

How much will you pay in mining fees post halving?

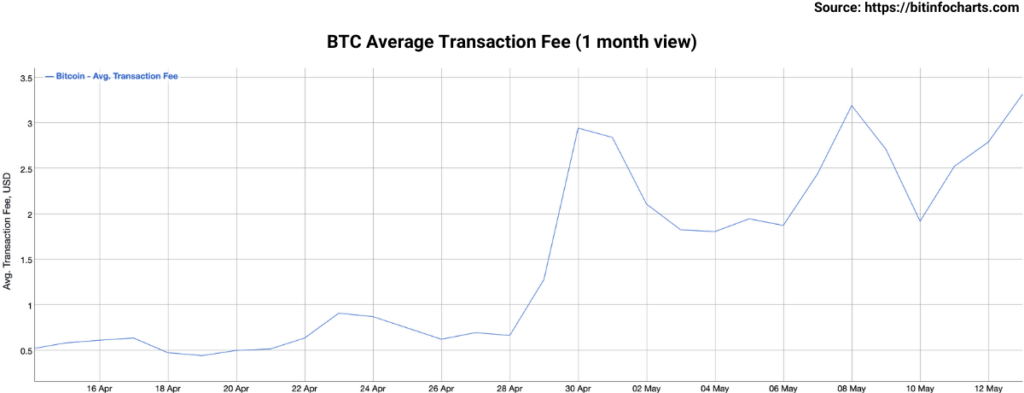

With the halving now behind us, mining fees have continued to move higher. As illustrated on the chart above, this upward trend started at the end of April. On April 11th, mining fees were around $0.39. At the time of writing, they had gone up to $3.32 for a regular transaction and $5.41 for a multi-sig transaction. That’s a painful 751% increase in cost in one month!

Switch and save up to 63% on mining fees

If your business is making single-signature payments, you are currently paying approximately $3.32 per transaction in mining fees.

If your business is making multi-signature payments, you are paying between 23% to 63% more i.e. between $4.08 and $5.41 per transaction! The exact surcharge depends on the amount of data the multiple signatures require and on network congestion.

Sending 10,000 transactions a month?

For those sending 10,000 transactions per month (~ 14 per hour), a multi-sig setup is costing between $7,630 to $20,920 more in mining fees alone. If we were to see mining fees climb back into the $10 price range, the added mining costs of the same setup could escalate past $60,000 per month.

As a business, how can we cut costs?

Contrary to multi-sig technology, multiparty computation (MPC) produces single signatures which do not require additional space in a block. That means a saving of 23% to 63% in space and therefore in mining fees. It also means not bidding up mining fees for faster confirmation times.

Thresh0ld, our Enterprise Grade Transaction Management platform leverages MPC technology to give your business stakeholders the peace of mind that your transactions are secure while keeping costs low.

Interested in making your business more efficient?

The Hidden Halving Message

A hidden message was inserted in block 629,999, the block preceding the halving. The message, included by mining pool F2Pool, reads: “NYTimes 09/Apr/2020 With $2.3T Injection, Fed’s Plan Far Exceeds 2008 Rescue.” In 2009, a similar message was inserted by Satoshi Nakamoto in the Genesis block: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” Both messages highlight the ongoing fragility of the financial system and point to the inflationary risk introduced by unlimited money printing.

Paul Tudor Jones

Macro investor Paul Tudor Jones announced to his clients he was buying Bitcoin as a hedge against inflation resulting from central bank money-printing. He compared the role of Bitcoin to the role that gold played in the 1970s. In a market outlook note entitled ‘The Great Monetary Inflation’, Jones, the founder and Chief Executive Officer of Tudor Investment Corp., said “The best profit-maximising strategy is to own the fastest horse. If I am forced to forecast, my bet is it will be Bitcoin.”