In focus:

- Why is the Halving so important?

- How does it affect mining fees?

- How does it affect your bottom line?

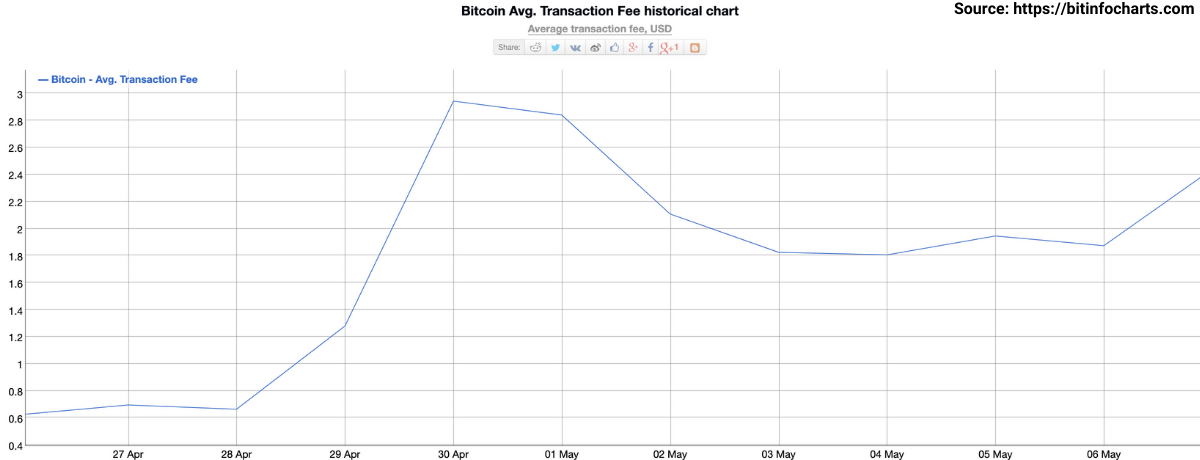

Over the last few days, Bitcoin mining fees spiked from around $0.60 to $2.94 on 30th April. At the time of writing, mining fees were on average $2.44.

Will they stay up? Or come back down post halving?

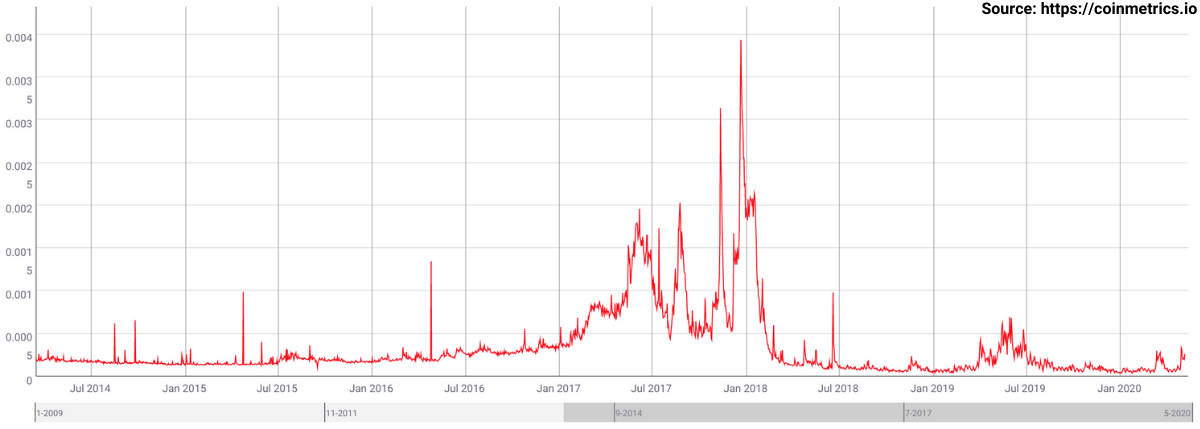

With the upcoming halving in just a few days, miners are about to receive half the block reward they’re currently earning. This, historically, has put upward pressure on the price of Bitcoin, and its transaction fees. In the past, we’ve seen mining fees in BTC terms tend to increase during bull markets and decrease during bear markets. This is mostly due to network congestion increasing when more people are trading and transacting during bull markets.

According to some analysts, the Bitcoin Winter ended in mid December 2018 and we’ve since been in a bull market.

Even the violent market correction that shook most asset classes on 12th March 2020, failed to reverse this upward trend. The BTC price remained above December 2018 levels and even recovered all its losses by 29th April 2020. Interestingly, 29th April happened to be the same day the upward pressure on BTC mining fees started to build.

If history is to repeat, we may be on the brink of another impressive rally. If not, bitcoin miners will need to adjust their mining fees accordingly to stay afloat after the halving.

At the height of the previous bull market, mining fees went as high as $54.91 per transaction. We may not revisit these levels but the sudden spike in mining fees over the last 7 days could be an indication of upward pressure building.

But there’s really only one question that matters for your business…

Mining Fees

If your business is making standard BTC payments, you are currently paying approximately $2.44 per transaction in mining fees.

If your business is making multi-signature payments, you are paying between 23% to 63% more i.e. between $3.00 and $3.98 per transaction! The exact surcharge depends on the amount of data the multiple signatures require and on network congestion.

Sending 1,000 transactions a month?

For those sending 1,000 transactions per month, a multi-sig setup is costing between $561 to $1,537 more in mining fees alone. If we were to see mining fees climb back into the $10 price range, the added mining costs of the same setup could escalate past $15,000 per month.

As a business, how can we cut costs?

Contrary to multi-sig technology, multiparty computation (MPC) produces single signatures which do not require additional space in a block. That means a saving of 23% to 63% in space and therefore in mining fees. It also means not bidding up mining fees for faster confirmation times.

Thresh0ld, our Enterprise Grade Treasury Management platform uses MPC technology for keyless security, operational cost-cutting and to give your business stakeholders the peace of mind that your transactions are secure while keeping costs low.

Interested in making your business more efficient?