How Multi-Party Computation is Redefining Cost-Effectiveness in Digital Asset Custody

The rapid expansion of the digital asset markets may be attributed mostly to the increasing volume of institutional investment, the introduction of tokenization, global remittances, and the widespread acceptance of DeFi and payment services facilitated by digital assets. However, cryptography extends beyond key utilizations.

Institutionally, transactions can be a lot more complex and these generate larger security concerns. Organizations may be hesitant to divulge information due to fears of hacking and security compromise, loss of control, and other dangers. However, through the use of cryptography and distributed ledger technology, multi-party computation (MPC) enables the analysis of data owned by several parties or the blind examination of data by third parties without the data custodian being privy to the nature of the analysis being performed.

What is Multi-Party Computation (MPC)?

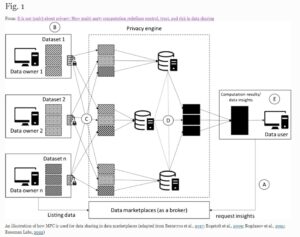

Multi-party computation is a type of cryptography that allows numerous participants to collaborate to obtain meaningful results without revealing their contributions to the calculation. The secret-sharing protocol is critical to MPC since it is both effective and scalable in terms of allowing additional people to participate in the calculation. Each participant follows this protocol by dividing the incoming data into several encoded parts known as secret shares, which are then utilized in a computation before being recombined to form the final output. Thus, inputted data can be secretly computed.

Image Source: Electronic Markets Journal

MPC in the Custody & Management of Digital Assets?

As the use of cryptocurrencies has grown, so is the sophistication of exchanges and wallets. However, cybercriminals often find ways to circumvent these safeguards. Fortunately, keeping cryptocurrency safe is one of MPC’s many applications. Features like secret sharing, which allows for the anonymous transfer of data between many users, are crucial to businesses that store sensitive information.

When it comes to keeping private keys or information safe, other approaches were initially utilised such as multi-signature (multi-sig) wallets and hardware security modules (HSMs). When comparing the two with MPC, it becomes evident that MPC is the more secure and cost-effective solution due to its blockchain-independent nature, real-time signature scheme modifications, and indefinite scalability.

How Does MPC Enhance Cost-Effectiveness?

When processing transactions on the Ethereum Blockchain, for instance, gas fee costs proportionally the number of operations performed. Simple transactions call for smaller transaction data and thus, lower fees. Smart contracts are necessary for more sophisticated transactions, such as those requiring the verification and recording of the signatures of many approvers on chain. Therefore, the gas consumption of these smart contract processes is sometimes multiplied by a factor as high as 10.

Combined with that, limits on the number of operations that can be included in a single block are enforced by Ethereum’s gas system. Having fewer transactions in a block has an effect on higher gas costs associated with more complex transactions.

Since the network becomes congested during peak transaction times, everyone must pay more for their transactions because of the increase in the number of bids. Due to increasing demand brought on by the widespread use of Ethereum and DeFi in particular, transaction fees for ETH have lately reached record all-time highs as people have had to bid over the minimum required to complete a transaction.

Secure MPC, in contrast to MultiSig, operates completely off-chain, giving the impression to Ethereum (and other blockchains) of being a simple transaction. This eliminates the huge costs of associated gas fees since it looks like a simple one-person transaction. Alongside the reduction of gas fees, MPC retains the added protection of several signatories, minimizing fees while maximizing security.

In conclusion, MPC technology outperforms other security models, mainstream adoption is still in its early stages. Institutional digital asset custodians are showing a preference for MPC-based solutions like THRESH0LD owing to its ability to provide simpler, safer, cheaper, efficient and faster transactions. THRESH0LD system cuts transaction fee costs on Ethereum by up to 85% and on Bitcoin by around 76%. On top of this, it reduces network congestion while improving security, making MPC the clear/ better choice for multiparty transaction approvals.

About THRESH0LD

THRESH0LD offers a single, simple-to-integrate API that helps digital asset businesses such as crypto exchanges, payment processors and OTC solutions cut tx fees, save time and enhance security.

THRESH0LD MPC supports 44 blockchain protocols and with DeFiBridge, you can enable swaps across many thousands of assets.

Found this piece interesting? Check out our other blog posts.