Crypto centralized exchanges (CEX) like traditional corporations tend to fold when they go bankrupt. This could happen when the exchange misappropriates customer funds and is unable to replace them. The recent FTX saga has increased investors’ scepticism about the safety of their funds on CEXs.

Crypto centralized exchanges (CEX) like traditional corporations tend to fold when they go bankrupt. This could happen when the exchange misappropriates customer funds and is unable to replace them. The recent FTX saga has increased investors’ scepticism about the safety of their funds on CEXs.

Crypto markets operate differently in contrast to traditional financial institutions and lack a fully regulated depository system, leaving users dependent on the good faith of CEXs. Although regular third-party audits could be performed to ensure the safety of users’ funds, these could easily be faked.

What if, however, clients had a foolproof way to monitor the whereabouts of their assets in real time? Let us briefly examine the promise of proof of reserves, what they mean for the safety of user funds, and how they might affect CEXs and Wallet-as-a-Service Providers.

Why implement Proof of Reserves?

In light of recent developments, the cryptocurrency market has been hit hard with many tokens plummeting in value. During these happenings, CEO Changpeng Zao of Binance declared that the exchange would implement a Proof of Reserves (PoR) audit to guarantee full disclosure about the management of customer funds.

This announcement came at a time when investor confidence was low and the market was displaying obvious signs of panic. This strategy has captured the attention of investors and gained widespread support and shows signs of reviving market stability.

What is Proof of Reserves?

PoR is a cryptographic way of confirming an exchange is liquid enough to handle all customer withdrawals. More specifically, it also shows individual users of a CEX that their digital assets are included in the published audits.

Through this method, a CEXs ability to hold sufficient funds to match user deposits is attested publicly via the use of cryptographic proofs and the verification of ownership of public wallet addresses, in addition to periodic third-party audits.

Using this cryptographic method, customers can check that their account balance has been included in the attestation thus enhancing user confidence.

How Does Proof of Reserves Work?

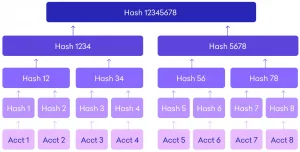

The method relies on the use of Merkle trees which preserves privacy and security during the cryptographic reconciliation of third-party reports. All account balance information is collected by the third party and presented in the form of a Merkle tree. The sum is then calculated using a Merkle root, which can only be calculated after all accounts have been balanced.

To confirm these amounts on public blockchains where assets are stored, the exchange provides digital signatures. Verified information about asset balances can then be found on the public blockchains. These figures need to add up to zero to be consistent. There will also be methods for customers to confirm that the assets they possess are legitimate. If data is altered, the Merkel root will change, suggesting that assets have been tampered with.

Image Credit: Kraken

How Proof of Reserves will Protect Users’ Funds

There must be a system of checks and balances in place, especially in a decentralized setting such as the Crypto space, where systems are ideally designed to not have a single point of failure.

In the event of bankruptcy, crypto institutions do not have government support. Therefore, PoR is a concept that allows for a higher level of transparency in asset management and will be used by CEXs to guarantee that their users’ assets are safely and securely stored in a centralized database using the Merkel tree technique.

How Proof of Reserves will Impact CEXs & Wallet-as-a-Service Providers

WaaS infrastructures like THRESH0LD MPC already possess most of the features provided by PoR. THRESH0LD WaaS offers total self-custody as funds are held on chain and available 24/7 to clients only. No member of the THRESH0LD team can view balances or make transactions on a client’s account.

In closing, the implementation of PoR by exchanges will positively impact CEXs and by extension WaaS Providers, as increased transparency equals increased trust and retail user confidence which all translates into more trading volumes and higher revenues.

About THRESH0LD

THRESH0LD offers a single, simple-to-integrate API that helps digital asset businesses such as crypto exchanges, payment processors and OTC solutions cut tx fees, save time and enhance security.

THRESH0LD MPC supports 44 blockchain protocols and a DeFiBridge that enables swaps across thousands of assets.

Found this piece interesting? Check out our other blog posts.