Bitcoin Mining Difficulty and Price Correlation

The amount of difficulty in mining new Bitcoin blocks is referred to as Bitcoin mining difficulty. The Bitcoin network is decentralized because of the PoW algorithm hard-coded into the source code by Bitcoin creator(s) Satoshi Nakamoto. The algorithm constantly readjusts the mining difficulty based on how many network miners are active to ensure blocks are mined accordingly.

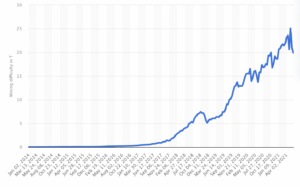

With Bitcoin’s price plummeting by +70% from its Q4 2021 high, mining difficulty has also dropped further strengthening the long-held notion that bitcoin’s spot price is directly correlated with mining difficulty as illustrated in the charts below.

Bitcoin average mining difficulty, 2014 to 2021(in terahash)

Credit: Statistica

BTC price chart from 2013 to 2022. Source- Tradingview

Below, we offer a dive into Bitcoin mining history and mining difficulty over the last decade, explaining how it works and why you should know about it.

What is Bitcoin mining difficulty?

Bitcoin’s network relies entirely on a decentralized transaction processing and consensus mechanism powered by miners, i.e., anyone can validate new transactions and add them to the network via new blocks as miners. In Bitcoin’s earliest days, you could mine just with your personal computer. However, PCs soon proved ineffective, and Bitcoin miners switched to graphic cards (GPU) for better mining.

Over time, miners migrated to application-specific integrated circuit (ASIC) miners specifically built for mining Bitcoin. This migration was due to Bitcoin’s increased mining difficulty. In addition, as Bitcoin adoption grew, more miners joined the network. As a result, the competition for mining new blocks became steeper and the cost of mining gear and power consumption increased. The underlying concept is that if it costs more to participate in validating network transactions, it will dissuade bad actors who might be trying to add invalid transactions.

The bitcoin network runs 24/7 and that is because the protocol ensures continuous mining without network breaks. The mining algorithm ensures a 10-minute wait before miners can confirm transactions/new blocks. Furthermore, Bitcoin’s mining difficulty is calculated with various formulas. But, the most common one is:

Difficulty Level = Difficulty Target/Current Target

How is bitcoin mining difficulty adjusted?

Bitcoin’s mining algorithm adjusts the mining difficulty when the network records a high number of miners, the difficulty is increased slightly. However, the same difficulty is reduced when miners drop off the network so the remaining miners can find it easier to mine.

Bitcoin’s mining difficulty is updated every 2016 blocks (i.e., roughly every two weeks). The 2016 block interval is called the difficulty epoch. During each difficulty epoch, the blockchain calculates if miners’ recent activity decreased or increased the time taken to mine a new block. If the block time is above 10 minutes, the mining difficulty is decreased and vice versa. With the calculation, the Bitcoin network determines the required percentage change in the mining difficulty that will bring the block time to 10 minutes.

An error in Bitcoin’s original protocol makes difficulty level adjustments based on the previous 2,015 blocks instead of the theorized 2016 blocks.

Mining difficulty & price correlation

In November 2021, Bitcoin hit an all-time high of $69,000. And while it maintained the $60,000 level, the difficulty in mining was at all-time high levels too. The increase in Bitcoin mining difficulty is related to bullish cycles where the price attracts more miners to validate the network. Larger mining difficulty also means there are a lot of pending transactions in the network, and users have to pay more fees to process their transactions.

Historical events + pump + drop in mining difficulties

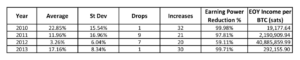

Since its emergence in 2009, Bitcoin has seen many increments in mining difficulty and drops correlated with price pumps and corrections. In 2009, the average difficulty was 0.966%, with a standard deviation of 3.865%. In 2010, we witnessed bitcoin gain its first market price increase. Aside from one difficulty drop, there were 32 difficulty increases that year.

2012 came with five difficulty drops in six months. However, a doubling in price between June and August saw mining difficulty increase again, with no drops until “The Halving” in November, which ended the year with two consecutive drops. Aside from a 9.46% difficulty drop at the beginning of the year, 2013 had two mega pumps causing 30 positive adjustments, averaging a 17.16% increase.

Table showing Bitcoin Mining difficulty statistics from 2010 to 2013

Source: Bitcoin Magazine

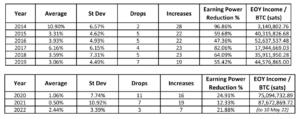

By the end of 2013, miners were favoring ASIC hardware over the previous GPU miners. Since then, Bitcoin’s mining difficulty has maintained its up-and-drop trend in direct correlation with the market prices, how many miners join the network, and the crypto’s trading activities. Below is a table detailing Bitcoin’s Year-to-Date dumps and increases in mining difficulties from 2014 to 2022.

Table showing Bitcoin Mining difficulty statistics from 2014 to 2022

Source: Bitcoin Magazine

In 2022, there have been seven increases and three drops in difficulty as of Q2. And it appears the mining landscape isn’t scaling down in competitiveness with the entrant of new players in the last few years such as Bitcoin mining startup GRIID and oil & gas giant Exxon Mobil. In November 2021, GRIID partnered with Intel the world’s largest chip maker to pioneer carbon-free mining.

In closing, mining difficulty adjustment is a profound perpetuity and security feature of bitcoin as it ensures that the protocol runs non-stop no matter what while also preventing malicious users from launching a 51% attack on the network.

If you found this content valuable, be sure to check out our other recent publications on bitcoin: