Asset Tokenisation: How Does it Work?

By Ken Akure | 07 July, 2023 |

Tokenised assets offer benefits and conveniences that traditional assets don’t. Entities can finance their operations by leveraging blockchain technology for the issuance, management, and trading of traditional financial assets. This opens up new possibilities & opportunities for businesses, investors, and financial institutions. In this article, we examine the concept of tokenisation, and how it works.

What is Asset Tokenisation?

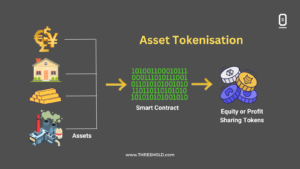

The tokenisation of assets involves converting traditional assets into digital tokens of equal value, that can be stored, managed, and transferred on the blockchain network. Unlike NFTs, which are irreplaceable digital assets, or stablecoins, which are pegged to fiat currency, a tokenised security tokens, for instance, are a form of digital representation of a person’s ownership of or a stake in an organisation/business.

Tokenised assets can be anything from real estate, shares to bonds, or commodities like gold. A good example of tokeinsed commodity is- Paxos Gold. Tokenised assets offer benefits that outweigh those of traditional business.

How Does It Work?

The tokenisation of assets involves a series of critical stages:

- Asset Selection: Firstly, the asset for tokenisation will have to be selected. This selection could cover various types of securities, real estate, commodities, stocks, bonds, or funds.

- Legal and Regulatory Compliance: Next, the asset will have to be vetted to ensure its compliance with the regulatory requirements applicable in that jurisdiction.

- Smart Contract Development: Thirdly, smart contracts will be developed that define the rules and conditions of the tokenised asset’s functionality, such as ownership rights, dividend distribution, transfer restrictions etc.

- Tokenisation Process: Once the legal and technical frameworks are completed, the asset will be tokenised by assigning a specific number of digital tokens to represent ownership of the asset.

Throughout the lifecycle of the tokenised asset, the smart contracts governing the tokens can be programmed to enforce compliance with relevant regulations. This includes features such as restrictions on the transfer of tokens to unauthorized parties or the automatic distribution of dividends to token holders.

Institutional Adoption of Tokenisation

Late last year, UBS (Union Bank of Switzerland) made strides by publicising its first digital bond, a 2.33% ($370 million) three-year unsecured bond issued and listed on SIX Digital Exchange (SDX). The institution made news as the first commercial bank to issue and list a digital bond on a regulated digital exchange platform. This groundbreaking event was followed by UBS’s issuance of $50 million in blockchain-based debt securities to high-level investors in Hong Kong and Singapore.

Only just recently, BOCI, the Bank of China’s investment arm, in collaboration with UBS, issued $28 million in digitally structured notes on the Ethereum blockchain. The BOCI has broken ground as the first Chinese financial institution to adopt the tokenisation movement and issue its securities on a public blockchain- Ethereum

Benefits of Tokenising Assets

- Increased Liquidity: By tokenizing an asset, investors are able to buy and sell fractions of the asset. As a result, more people are able to invest, and the market’s overall liquidity improves.

- Accessibility: Tokenised assets can be exchanged around the clock, on any digital market, regardless of time zone or location. Because of this, investing in the financial market is more practical now than ever.

- Cost Efficiency: By removing middlemen, tokenisation helps reduce the price of asset purchases. It also lessens administrative burdens by streamlining compliance requirements.

- Enhanced Transparency and Security: Blockchain technology’s immutable and transparent transaction ledger maintains ownership integrity and discourages fraud. This decreases the need for third-party verifiers without compromising trust.

- Fractional Ownership: Tokenisation enables investors to own fractional portions of previously inaccessible high-value assets due to cost. Due to the fractional nature of tokenised assets, investors are able to purchase tokens at affordable prices, enabling multiple fractional ownership of an asset and thereby democratising access.

How Thresh0ld Can Help with Asset Tokenisation

Our infrastructure is designed to help businesses building with digital assets achieve all forms of efficiency. Here is how we can help:

- Enable the easy conversion of various assets into tokens.

- Generate new tokens through a minting process.

- Enable you to maintain self-custody of your tokens

- Eliminate unnecessary tokens by burning them how/when you want to manage the token supply.

- Our DefiBridge feature allows for seamless connectivity with other DeFi applications.

- Effortlessly manage and automate your token operations via our intuitive dashboard

Are you looking to tokenise any assets? Talk to Us today!