DAOs in recent times have garnered wide adoption in the crypto world and have fundamentally changed how we view governance. In this article, we access the benefits and risks of DAOs, highlighting how they work and their decision-making process.

What is a DAO?

Decentralized Autonomous Organizations, or DAOs, are decentralized companies on the blockchain jointly owned and managed by members through codes called smart contracts. In a DAO, members work together to create, distribute and provide value for the collective goal. Additionally, DAOs do not have a centralized authority as decisions in the network are reached through a member voting system.

How do DAOs work?

DAOs do not work like typical corporate companies. A core difference is ownership. All members collectively own the DAO and to be a member of the DAO, you would have to hold the governance token. DAOs operate in three main ways; smart contract creation, funding, and deployment on the blockchain. The smart contracts contain the rules governing the network. However, any stakeholder can propose a major network change that gets voted on during specific periods.

How are decisions made in DAOs?

Decision-making is also different in DAOs. While executives hierarchically govern traditional businesses, DAOs use a decentralized approach. That means smart contracts encoded with DAO rules transfer all the decision-making from centralized authorities to community members. For example, members can submit proposals, which other members then vote on. Members are eligible to vote because they hold tokens.

In DAOs, whoever possesses more tokens, has increased voting power, and sometimes token ownership thresholds exist for submitting proposals. This decentralized governance system reduces the need for bureaucracy and its associated costs. Secondly, decisions made in DAOs are transparent and visible for anyone to see on the blockchain.

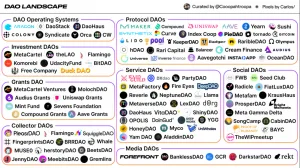

DAO Landscape

Today, there are more than 100 DAOs managing over $10B in assets. These DAOs fall under different categories based on the purpose that they serve as depicted in the graphic below.

Credit: Coopahtroopa

Of particular note among the categories is Protocol DAOs. They function by moving power from the control of the project core team to the community and creating avenues for; yield farming, liquidity mining, fair launches, lending and token swapping.

Protocol DAOs such as Uniswap, Sushi, Aave, Maker, Pankcakewsap, Yearn, Curve DAO, Compound, Synthetix Network etc are accessible from within THRESH0LD.

Access to these protocols can be gained via THRESH0LD’s DeFiBridge using any of the following options:

- User Interface – Users can connect using a manual operation method, this involves calling an ABI (Application Blockchain Interface) directly from the THRESH0LD User Interface.

- API – Technical users / DevOps teams can connect through an API that allows the wallet to send an ABI request to any of these protocols.

- Wallet Connect – Users can Interact with these protocols via Wallet connect

Need help accessing any of these DAOs?

Risks of DAOs

- Vulnerability of Code

DAOs depend too much on smart contracts. They are built on the idea that ‘code is law’, and that smart contracts will take care of everything. But that is sometimes not the case as code vulnerabilities are common. There have been many exploits of DAOs in crypto history a notable reference being the $120M hack of BadgerDAO in 2021.

Hence, having an effective fail-safe mechanism that kicks in to prevent a DAOs vault from being drained would be essential in mitigating risk.

2. Plutocracy and the Concentration of Voting Power

Governance is done through voting and hence relies strongly on the possession of DAO tokens. This often results in government by the wealthy where entities with the highest amount of tokens can propose and vote into effect policies that further only their interests. This suggests that DAOs aren’t as decentralized as they should be.

3. Regulations

DAOs as business entities are subject to regulations. However, this poses a problem as there is a lack of definite rules and regulations for taxation and DAO management. In addition, a community-based leadership model makes it difficult to reach decisions quickly and implement regulations.

Benefits of DAOs

- Transparency and Accountability

DAOs are transparent and less susceptible to corruption, and other human single points of failure. For context, there is little or no transparency in traditional finance as records are not publicly verifiable.

In contrast, a DAOs operation can be closely monitored by anyone as all records are open. Investment DAOs even enable members to create special interest DAOs, speculate and vote on projects they would like to invest in

2. Different Incentivization Options

DAOs have a variety of compensation options for contributors. While most DAOs core contributors might work full-time and earn salaries, other members can earn through individual tasks or ‘bounties’ organized by the DAO. In bounties, contributors work to earn the DAO’s native token or stablecoins.

Conclusion

DAOs strengthen the concept of democracy and foster inclusiveness in organizational settings. However, widespread adoption won’t happen until code vulnerability concerns and regulatory compliance issues are adequately addressed.